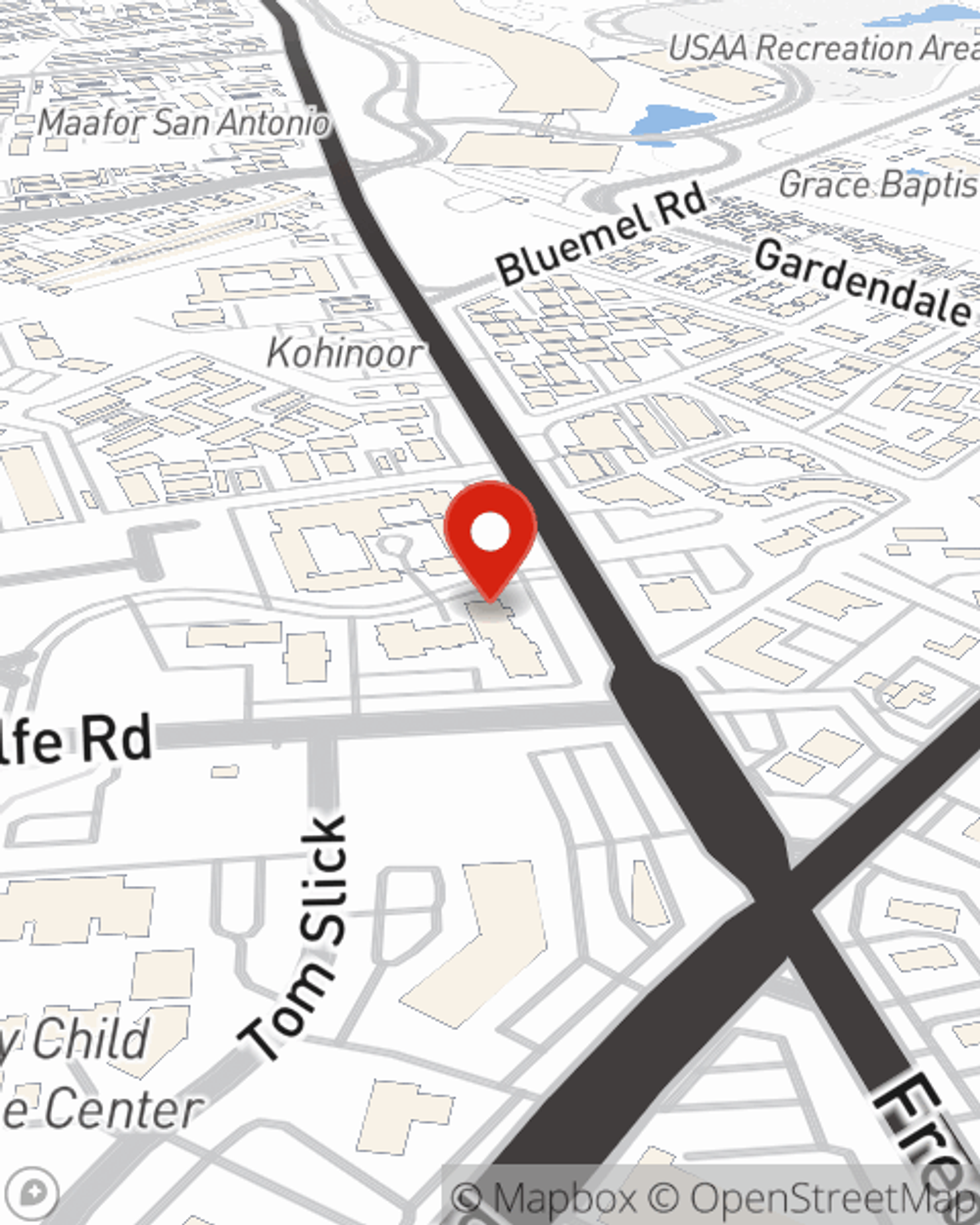

Renters Insurance in and around San Antonio

Get renters insurance in San Antonio

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Boerne

- Helotes

- Leon Springs

- Fair Oaks Ranch

- Bergheim

- Bulverde

- Kerrville

- Bexar County

- Kendall County

- Comal County

- Kerr County

- Castroville

- Medina

- New Braunfels

There’s No Place Like Home

Your things are important; keeping them secure should be just as important. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your stereo to your artwork. Not sure how much insurance you need? Not to worry! Jessica Carlos is here to help you assess your needs and help pick the appropriate policy today.

Get renters insurance in San Antonio

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the repair or replacement of your belongings. Renters insurance helps guard your personal possessions in case of the unexpected.

There's no better time than the present! Get in touch with Jessica Carlos's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Jessica at (210) 616-0662 or visit our FAQ page.

Simple Insights®

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Jessica Carlos

State Farm® Insurance AgentSimple Insights®

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.